st louis county mn sales tax

The Minnesota sales tax rate is currently. Property Tax assistance is available through application at Home Help MN.

Louis County Sales Tax is collected by the merchant on all qualifying sales made within St.

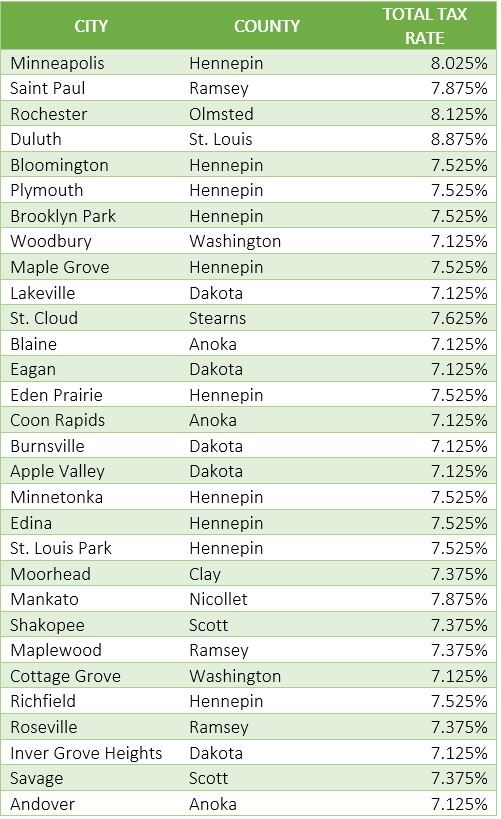

. Find a home Find a Realtor Mortgage Sell Insights Services Realtor careers Español Contact. Lots of historic still in the home. Minnesota has 231 cities counties and special districts that collect a local sales tax in addition to the Minnesota state sales taxClick any locality for a full breakdown of local property taxes or visit our Minnesota sales tax calculator to lookup local rates by zip code.

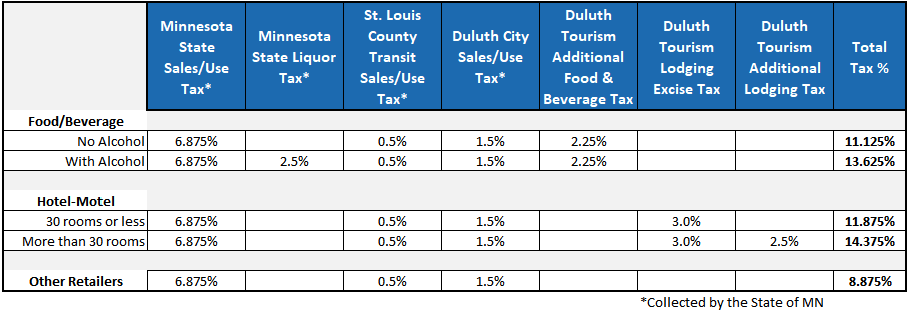

Minnesota has a 6875 sales tax and St Louis County collects an additional NA so the minimum sales tax rate in St Louis County is 6875 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in St. The transit use tax applies to taxable items used in the County if the local sales tax was not paid. All contractors or sub-contractors must carry liability insurance and meet Minnesota Workers Compensation Law requirements.

Mail payment and Property Tax Statement coupon to. The 2018 United States Supreme Court decision in South Dakota v. Saint Louis County MN currently has 280 tax liens available as of September 7.

A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval. The County sales tax rate is. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Saint Louis County MN at tax lien auctions or online distressed asset sales.

To calculate the sales tax amount for all other values use our sales tax calculator above. May 15th - 1st Half Agricultural Property Taxes are due. Louis County Minnesota sales tax is 738 consisting of 688 Minnesota state sales tax and 050 St.

Information on timber sales on state tax forfeited land. A Certificate of Liability Insurance must be submitted and updated yearly to. St Louis County Taxes information registration support.

This is the total of state and county sales tax rates. Complete Policy Manual of the St. Louis County Courthouse 100 North 5th Avenue West Duluth MN 55802.

If you need access to a database of all Minnesota local sales tax rates visit the sales tax data page. Did South Dakota v. The Land Minerals Department manages just under 900000 acres of tax forfeit rural land and 13000 urban parcels.

The St Louis County sales tax rate is. What is the sales tax rate in St Louis Park Minnesota. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes.

The minimum combined 2022 sales tax rate for St Louis County Minnesota is. See details for 2924 Hampshire Avenue S Saint Louis Park MN 55426 Single Family 3 bed 2 bath 1404 sq ft 399900 MLS 6258233. November 15th - 2nd Half Manufactured Home Taxes are due.

This is the total of state county and city sales tax rates. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. US Sales Tax Rates.

4 beds 3 baths 2706 sq. Louis County does NOT guarantee access to these lands. You can find more tax rates and allowances for Saint Louis County and Minnesota in the 2022 Minnesota Tax Tables.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 773 in St. The Minnesota state sales tax rate is currently. To further accelerate investment and.

The St Louis Park sales tax rate is. 2909 Minnesota St Louis MO 63118 295000 MLS 22057515 Charming and renovated. Ad New State Sales Tax Registration.

Tax-forfeited land managed and offered for sale by St. The minimum combined 2022 sales tax rate for St Louis Park Minnesota is. MN 55802 -landdeptstlouiscountymngov- 2187262606.

Louis County Board enacted this tax along with an excise tax of 20 on motor vehicles sold by licensed dealers beginning in April 2015. What is the sales tax rate in St Louis County. November 15th - 2nd Half Agricultural Property Taxes are due.

Parcels vary in size from a few square feet to 100s of acres. These buyers bid for an interest rate on the taxes owed and the right to. Below are some tools to help you find property information that you may be looking for.

Enter into hall with looks to. All sales are subject to existing liens leases or easements. Louis County Auditor St.

Minnesota Statute Chapter 282 gives the County Board the County Auditor and the Land Minerals Department authority over the management and sale of tax forfeited lands. Louis County local sales taxesThe local sales tax consists of a 050 special district sales tax used to fund transportation districts local attractions etc. Louis County Greater MN Transportation Sales and Use Tax Transportation Improvement Plan adopted December 2 2014 County Board File No.

The total sales tax rate in any given location can be broken down into state county city and special district rates. This 05 percent transit tax applies to retail sales made within St. The current total local sales tax rate in Saint Louis Park MN is 7525.

The December 2020 total local sales tax rate was also 7525. Louis County Courthouse 100 N 5th Avenue West 214 Duluth MN 55802. All numbers are rounded in the normal fashion.

The right to withdraw any parcel from sale is hereby reserved by St. Saint Louis County Sales Tax Rates for 2022. Sales Tax Table For St.

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. Saint Louis Park Details Saint Louis Park MN is in Hennepin County.

Minnesota Sales Tax Rates By City County 2022

Minnesota Sales Tax Guide For Businesses

St Louis County Land Sale Home Facebook

St Louis County Minnesota Our County About St Louis County Organizational Structure

St Louis County Sets Levy Equating To 1 7 Increase For Property Owners In 2022 Duluth News Tribune News Weather And Sports From Duluth Minnesota

St Louis County Land Sale Home Facebook

St Louis County Land Sale Home Facebook